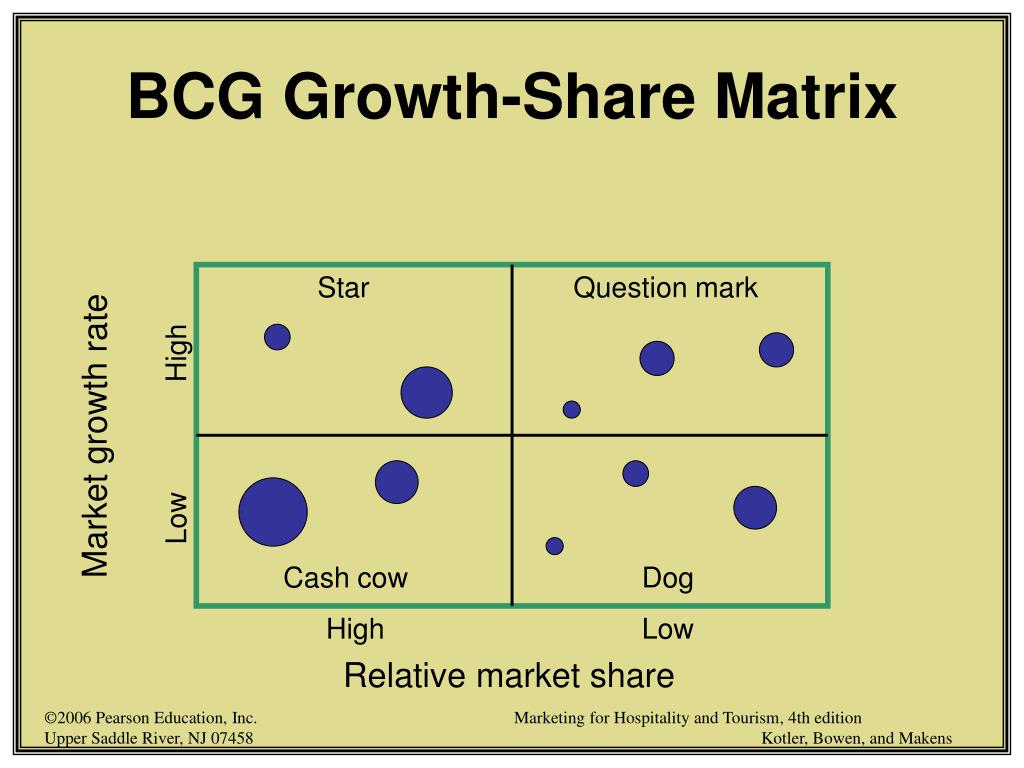

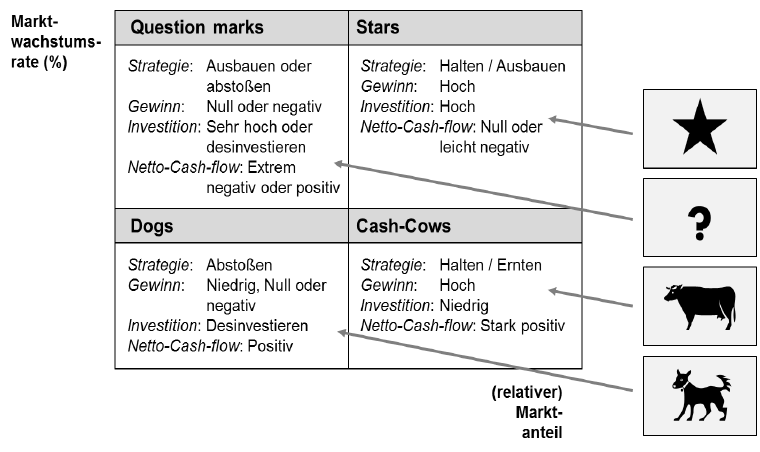

One such assumption that we take in BCG matrix is that if a company has very good market share then it is successful from a financial standpoint. The 2nd variable on X- axis is the Relative Market share. Now every company is fighting to get some share in the fixed pie. Say for examples if your company’s sales is growing by 15%, but the industry is growing by 20%, you are lagging behind your competition by 5% or Industry is growing at 12%, then you are leading ahead of your competition by 3%.Ĭompetition is very severe in markets that has low growth. Market Growth Rat e = Total sales in current year / Total sales in previous year

So the formulae to calculate Market growth rate is

It is the rate at which a market’s size is growing. We can figure out the market growth rate from industry reports, which are usually available online.

The 1st variable on Y- axis is is the Market Growth Rate. Before we understand how to construct BCG Matrix lets understand these terms firstģ) SBU (Strategic Business Units).

0 kommentar(er)

0 kommentar(er)